Annual rate of depreciation formula

The DDB rate of depreciation is twice the straight-line method. Up to 8 cash back Annual.

Depreciation Rate Formula Examples How To Calculate

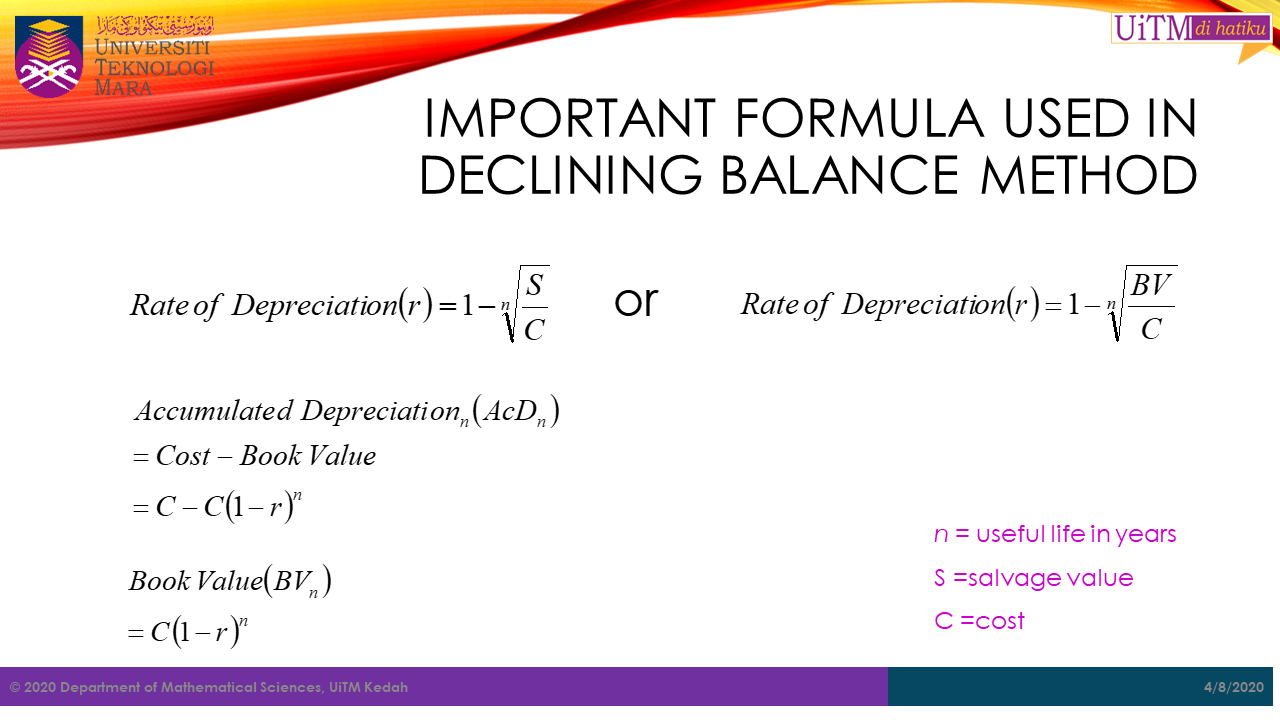

This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula.

. In year one you multiply the cost or beginning book value by 50. Annual rate of depreciation formula Minggu 04 September 2022 Edit Depreciation Rate of depreciation x 100 Diminishing balance or Written down value or. You then find the year-one.

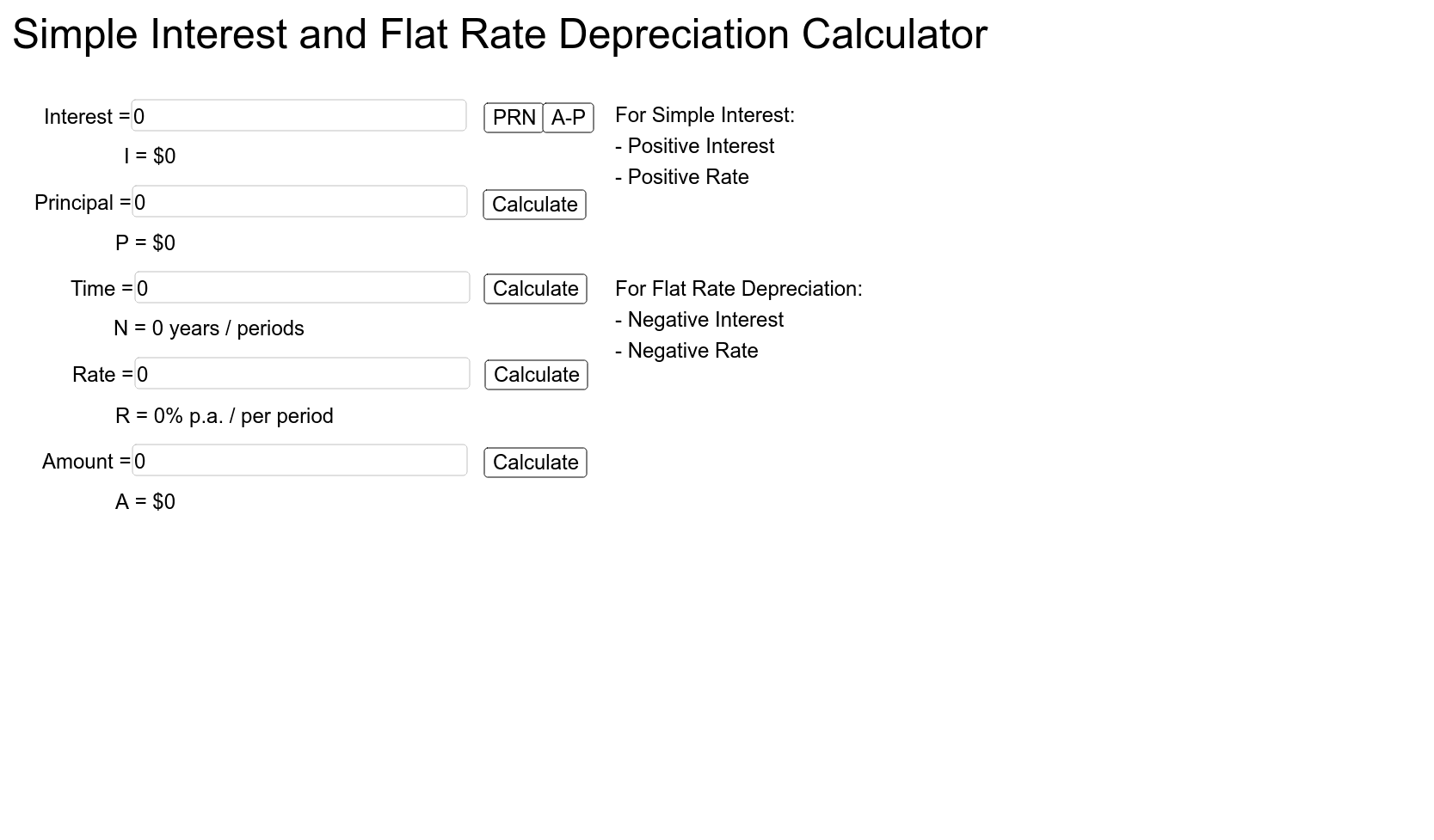

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Annual Depreciation Expense Cost of the Asset Salvage Value Useful Life of the Asset. Annual Depreciation Expense 8000 1000 7 years.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Depreciation per year Book value Depreciation rate. Simply divide the assets basis by its useful life to find the annual depreciation.

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Annual depreciation in of units purchase price - salvage value x of units produced that year total of units expected over lifetime This method works best for.

The assumption in this depreciation method is that the annual cost of depreciation is the fixed percentage 1 - K of the Book Value BV at the beginning of the. For example an asset with a 10000 basis and a useful life of five years would depreciate at a. Depreciation Percentage - The depreciation percentage in year 1.

Next determine the depreciation rate category based on the propertys natureIt would be either 5 10 or 100 which would be used to calculate the annual depreciation of the.

How To Calculate The Depreciation Of Currency Accounting Education

Unit Of Production Depreciation Method Formula Examples

Lesson 8 8 Appreciation And Depreciation Youtube

Math Sc Uitm Kedah Depreciation

Accumulated Depreciation Definition Formula Calculation

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Examples With Excel Template

Gt10103 Business Mathematics Ppt Download

Depreciation Rate Calculator Hot Sale 51 Off Www Ingeniovirtual Com

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template